Commodity price shocks

Commodity price shocks are times when the prices for commodities have increased suddenly.[1]

1971–1973

At the time of the 1973 oil crisis, the price of corn and wheat went up by a factor of three.

2005–2008

The 2007–08 world food price crisis saw corn, wheat, and rice go up by a factor of three when measured in US dollars.

Second half of 2014

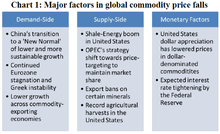

Global commodity prices fell 38% between June 2014 and February 2015. Demand and supply conditions led to lower price expectations for all nine of the World Bank‟s commodity price indices - an extremely rare occurrence. The commodity price shock in the second half of 2014 cannot be attributed to any single factor or defining event.[3] It was caused by a host of industry-specific, macroeconomic and financial factors which came together to cause the simultaneous large drops across many different commodity classes. Amongst these, the transition of China's economy to more sustainable levels of growth and the shale-energy boom in the United States were the dominant demand-side and supply-side factors governing the downturn in global commodity prices.[4]

See also

External links

References

- ↑ https://scholar.google.com/scholar?hl=en&q=commodity%20price%20shocks&um=1&ie=UTF-8&sa=N&tab=ws

- ↑ Saggu, A.; Anukoonwattaka, W. (2015). "China's 'New Normal': Challenges Ahead for Asia-Pacific Trade". United Nations ESCAP. Retrieved 9 July 2015.

- ↑ Saggu, A.; Anukoonwattaka, W. (2015). "Global Commodity Price Falls: A Transitory Boost to Economic Growth in Asia-Pacific Countries with Special Needs". United Nations ESCAP. Retrieved 27 March 2015.

- ↑ Saggu, A.; Anukoonwattaka, W. (2015). "Commodity Price Crash: Risks to Exports and Economic Growth in Asia-Pacific LDCs and LLDCs". United Nations ESCAP. Retrieved 5 March 2015.