Stochastic volatility jump

In mathematical finance, the stochastic volatility jump (SVJ) model is suggested by Bates.[1] This model fits the observed implied volatility surface well. The model is a Heston process with an added Merton log-normal jump.

Model

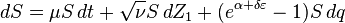

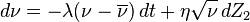

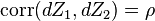

The model assumes the following correlated processes:

[where S = Price of Security, μ = constant drift (i.e. expected return), t = time, Z1 = Standard Brownian Motion etc.]

References

This article is issued from Wikipedia - version of the 3/3/2016. The text is available under the Creative Commons Attribution/Share Alike but additional terms may apply for the media files.